TIPS (Real Rates)

NEGATIVE REAL RATES: Is that really possible?

|

I |

n October 2010, Treasury Inflation Protected Securities

(TIPS) had negative yields. TIPS are bonds whose face value

increases by the amount of inflation. So the yield on TIPS

measures the "real interest rate" which is the interest rate

that would be charged in a world where these is no inflation.

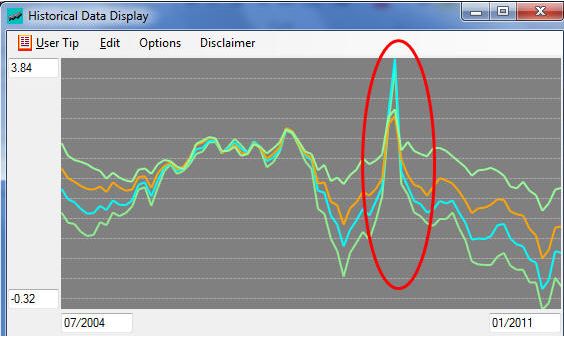

How can this yield be negative? This interactive chart shows you

the current trends in real rates:

Understanding TIPS Implied Rate Behavior

One explanation for negative real rates implied from TIP's prices is that if there is a sharp increase in inflation buyers will receive more than what they lent. So if you expect a sharp increase in inflation, you should be willing to pay more for TIPS, i.e. demand a low yield. In the extreme case, as happened in 2010, you may be willing to buy the bonds at a negative yield.

To see the actual results click on TIPS and negative real rates.

Subtleties Associated with Real Rate Behavior

If you are interested in this economic barometer, take a look at the interactive charts provided above. You can see the current real rate trends for different time horizons. Click on the dropdown to see details for each maturity and for further information click the Interpretation tab above for help on interpreting the charts.

However, there are some additional subtleties that need to be taken into account when looking at these charts. First, you should have a clear picture as to what the current inflation expectations are (see menu item inflation above).

Why is this the case?

Consider if deflation is expected. Now the principal or face value of the TIPS is expected to reduce which can only be made up by having real rates rise and thus the price of TIPS fall.

Has this ever happend that real rates explode because of inflationary fears?

Yes, for example in the economic crisis of 2008/2009

In the above chart the real rates from TIPS spiked because inflationary expectations had turned to deflationary expectations. This is what worried the Federal Reserve Bank at this point in time in history. You can also see a spike in mid 2022.

office (412)

967-9367

office (412)

967-9367